It seems a bit scary out there in the investment world, right? We’ve got potentially two wars happening, housing in the tank with 8% interest rates, slowing earnings from companies and overall quite a bit of fear and angst regarding investments right now. But what if?

What if the market actually starts going up from here?

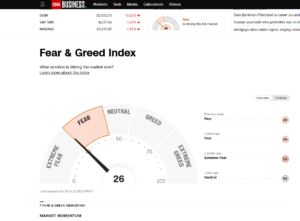

As a market technician, I tend to lean on the actual stock or index prices along with sentiment to shape potential outcomes. Right now we have very negative sentiment in the markets and a lot of folks are hanging out in high yielding money markets and T Bills, which is fine but I’ve never seen a case where the majority was on the right side. I’m not saying that there isn’t risk of further decline in the markets, but we are reaching some extreme oversold levels and when coupled with the bearish sentiment, the contrarian in me starts looking for a potential reversal.

With that said, my clients are definitely not overweight on stock allocations currently, but I’m watching for a trigger to potentially increase. (actually clients are underweight right now and sitting on a fair bit of cash)

So, my question is what if we are at peak interest rates and they start to decline noticeably? And what if 3 months from now money markets and T bills are yielding a lot less than today? By that time the markets will have rebounded quite a bit and folks on the sidelines will be chasing a much higher market, just in time for it to turn back down. Just tossing this out as a potential scenario.

You will have to determine how probable it could be………

(**not investment advice – due your own due diligence)